Information subject to change – Please refer to the UK Government website for the most up-to-date position.

Please Note: There have been significant updates made to the way the Coronavirus Job Retention Scheme will operate after 30th June 2020. Click here to see our blog outlining the changes to the Coronavirus Job Retention Scheme taking effect on 1st July 2020.

What is the UK Government doing to support employers who may have to lay off employees due to the Coronavirus (COVID-19) pandemic?

Coronavirus Job Retention Scheme

The UK Government have announced their response to the impact of Coronavirus (COVID-19) on workers by providing employers with a taxable grant to cover 80% of wage costs – capped at £2500 per month, per furloughed employee – to help cover the costs of employees who would, otherwise, have to be made redundant due to the impact of Coronavirus (COVID-19).

The Scheme has now been extended to cover the period March 2020 – June 2020, for all employees on the payroll at 19 March 2020, the day before the scheme was announced. This date has been updated from 28 February 2020, with employers able to re-employ those employees who were let go on or after the 19 March 2020, so long as they were on the payroll at 19 March 2020.

The Coronavirus Job Retention Scheme claim portal is now live and payments will made directly to the employer’s bank account. To make a claim you will need to use the Government Gateway user ID and password you received when you registered for PAYE online.

Can I submit a claim to the Coronavirus Job Retention Scheme?

All UK businesses with a UK bank account, including charities and not-for-profit organisations, will be eligible to make a claim through the Coronavirus Job Retention Scheme to cover up to 80% of wage costs for furloughed employees.

Funds will be paid as a taxable grant – meaning that employers will have to pay tax on the funds, but will not have to repay the funds as they would with a loan.

Who qualifies as a furloughed employee?

An employer will be able to designate an employee as furloughed if they would otherwise have had to lay off the employee or make their position redundant due to the current Coronavirus (COVID-19) pandemic. To qualify for a grant through the Coronavirus Job Retention Scheme, the employee previously had to be on the PAYE payroll at 28th February 2020, but this has now bee extended to the 19th March 2020. The employer must also notify the employee in writing that they are being furloughed and retain a copy of this communication.

Furloughed employees can be on any type of employment contract, including:

- full-time employees

- part-time employees

- employees on agency contracts

- employees on flexible or zero-hour contracts

The scheme will also cover those employees who were made redundant since 19 March 2020, if they were on the payroll at that date and are rehired by the employer. However, furloughed employees must not undertake work for the employer whilst furloughed.

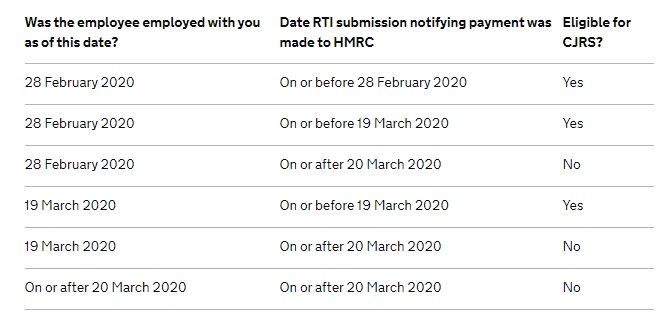

The following table has been provided to help employers determine which employees are eligible for the Scheme:

Can limited company directors be furloughed?

In addition to employees, salaried company directors are also eligible to be furloughed and receive support through this scheme. Where one or more individual directors’ furlough is so decided by the board, this should be formally adopted as a decision of the company, noted in the company records and communicated in writing to the director(s) concerned.

Where furloughed directors need to carry out particular duties to fulfil the statutory obligations they owe to their company, they may do so provided they do no more than would reasonably be judged necessary for that purpose, i.e. they should not do work of a kind they would carry out in normal circumstances to generate commercial revenue or provides services to or on behalf of their company.

What will be covered and how will grant payments be calculated?

Employers will be able to make a claim for each employee furloughed, for the lower of £2,500 or 80% of an employee’s regular wage or salary, plus associated Employer National Insurance and minimum auto-enrolment employer pension contributions based on that amount. Any fees, commission or bonuses should not be included in the calculation.

An employer may choose to provide a top-up to the employee, above the funds provided by the Coronavirus Job Retention Scheme, and pay an employee their full salary, but this is not required to be part of the Scheme and is at the discretion of the employer. It should also be noted that salary/wages for a furloughed employee will still be subject to the usual income tax and other deductions/contributions, but an employer must not charge a fee on the money that is granted.

For employees who receive a fixed salary, whether they usually work fulltime or part-time, the employee’s gross salary (before tax) on 28 February should be used to calculate the 80% recovery claim.

For employees with variable wages, the calculation for how much you can claim will depend on whether or not the employee has been employed for a full 12 months prior to the claim.

For employees who have been employed for at least 12 months prior to the claim being made, employers may claim for the higher of:

- The same month’s earnings from the previous year

- Average monthly earnings from the 2019-20 tax year

For employees who have been employed for less than 12 months prior to the claim being made, employers may claim the average of their monthly earnings since the employee started work.

If your employee only started working for you in February 2020 then you should pro-rata their earnings so far.

How do I make a claim to the Coronavirus Job Retention Scheme?

The Coronavirus Job Retention Scheme online portal is now live for employers to make their claim and may be found here.

To claim, employer’s will need to provide:

- Their ePAYE reference number

- The number of employees being furloughed

- The claim period (start and end date)

- The amount to be claimed

- The employer’s bank account number and sort code

- The employer’s contact name

- The employer’s phone number

Whilst employers will need to calculate the amount they are claiming, HMRC retains the right to retrospectively audit all aspects of a claim.

Claims are limited to once per 3-week period, which is the minimum amount of time an employee may be furloughed for, and may be backdated to 1 March 2020, if applicable.

How will I receive my grant from the Coronavirus Job Retention Scheme?

For claims submitted before the 22nd of the month, payment will be made by BACS to the UK bank account provided as part of the claim and should be received by the end of the month.

Where can I find out further information about the UK Government’s Coronavirus Job Retention Scheme?

The UK Government website provides updates and additional information for those who would like to find out more about the Coronavirus Job Retention Scheme here.

What other help has the UK Government made available to support businesses during the Coronavirus pandemic?

- Self-employed traders: Claim up to £2,500 per month through the Self-Employment Income Support Scheme

- Payments on Account: 6-month deferral for those due to make payments in July 2020

- Reclaim Statutory Sick Pay (SSP): Up to 2 weeks per eligible employee – for sickness absence due to COVID-19

- VAT Payments: 3-month deferral for those with VAT payments due between 20 March 2020 and 30 June 2020

- Additional Help: Available from HMRC’s ‘Time to Pay Scheme’ on a case-by-case basis

Last updated 30 April 2020